Hot Topic Highlight – Flooding

- Jen Lemen

- Jun 6, 2023

- 9 min read

Updated: Oct 28, 2023

Building a Better You

Property Elite’s sole aim is to build better property professionals - supporting your career every step of the way, whether you are an AssocRICS or RICS APC candidate or a MRICS or FRICS Chartered Surveyor simply seeking engaging CPD.

We provide a wide range of training and support, so why not find out more on our website about how we might be able to support you? We work with candidates across all RICS APC and AssocRICS pathways, routes to assessment and geographic regions.

Don’t forget to sign up online for your free 15 minute AssocRICS or RICS APC consultation, including a review of your referral report if you have been referred. You can also book your bespoke training or support services directly through our eShop.

Not sure about signing up? Make sure you read what our recent successful candidates have to say in our Testimonials.

What is this week's blog about?

In this week’s blog, we take a look at flooding, how to check flood risk and the impact of this on valuation. This is essential reading for all RICS APC and AssocRICS candidates taking Valuation as a technical competency.

The idea for this blog was triggered by the publication of the new RICS Consumer Guide: Flooding. This is worthy reading for all RICS APC and AssocRICS candidates.

What is flooding?

Everyone will have heard of or seen the impacts of flooding; simply an overflow of water onto usually dry land.

Flooding is caused by a variety of sources, such as:

Surface water

Groundwater

River levels becoming too high

Water running off high ground

Coastal

Storms and extreme weather

Burst water main outside a property or pipework internally

Flooding is likely to be experienced more frequently in future due to the effects of climate change.

What are the impacts of flooding?

Flooding can have a severe impact on the built and natural environments. This can include damage to property and life (in the worst case scenario), remediation cost after flooding, reduced property value, building insurance issues, difficulty in securing mortgage finance and ongoing disruption and stress.

How can I check if a property is at risk of flooding?

A good starting point is the Government website, where you can check the long term flood risk for an area in England.

Flood risk is categorised into four zones (excerpt from https://www.gov.uk/guidance/flood-risk-and-coastal-change#para77):

Table 1: Flood Zones

Flood Zone | Definition |

Zone 1 Low Probability | Land having a less than 0.1% annual probability of river or sea flooding. (Shown as ‘clear’ on the Flood Map for Planning – all land outside Zones 2, 3a and 3b) |

Zone 2 Medium Probability | Land having between a 1% and 0.1% annual probability of river flooding; or land having between a 0.5% and 0.1% annual probability of sea flooding. (Land shown in light blue on the Flood Map) |

Zone 3a High Probability | Land having a 1% or greater annual probability of river flooding; or Land having a 0.5% or greater annual probability of sea. (Land shown in dark blue on the Flood Map) |

Zone 3b The Functional Floodplain | This zone comprises land where water from rivers or the sea has to flow or be stored in times of flood. The identification of functional floodplain should take account of local circumstances and not be defined solely on rigid probability parameters. Functional floodplain will normally comprise: • land having a 3.3% or greater annual probability of flooding, with any existing flood risk management infrastructure operating effectively; or • land that is designed to flood (such as a flood attenuation scheme), even if it would only flood in more extreme events (such as 0.1% annual probability of flooding). Local planning authorities should identify in their Strategic Flood Risk Assessments areas of functional floodplain and its boundaries accordingly, in agreement with the Environment Agency. (Not separately distinguished from Zone 3a on the Flood Map) |

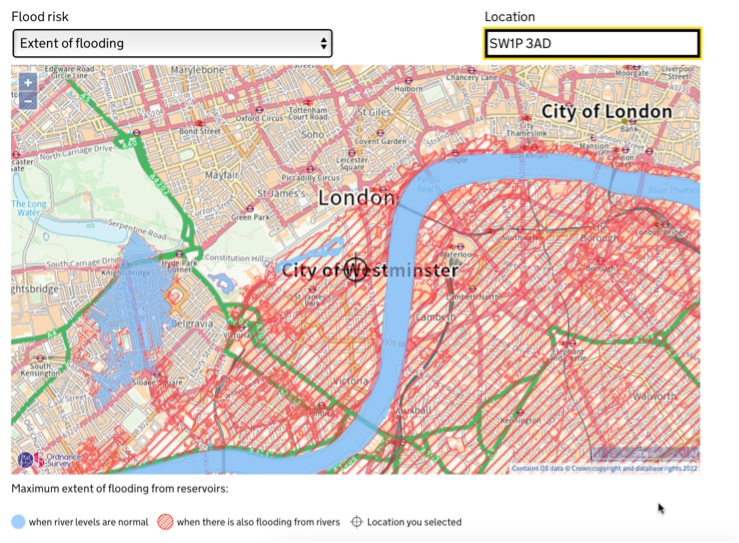

For example, if we wanted to look at the risk of flooding for RICS HQ in London, we would type in the postcode, SW1P 3AD.

This provides a summary of flood risk from different sources (with associated maps below):

Rivers and the sea – very low

Surface water – very low risk

Reservoirs – risk of flooding

If we wanted to investigate the risk of flooding further, we could also:

Request the flooding history from the Environment Agency

Commission a specialist flood risk report (or for a residential property, checking if one was commissioned during the purchase conveyancing process)

Speak to the occupier, landlord/owner, neighbours or others who may know about the flood history of the building

Search for historic new articles about flooding in the area

Physically inspect the property to check it’s proximity to nearby water sources and if it has any flood resilience measures installed

When physically inspecting a property in respect of flooding, things to look for are:

Proximity to a watercourse or body of water, such as a river, stream or the sea

Location at the bottom of a hill or in a dip

Nearby river or coastal flood defences

How can I report on flooding?

RICS Guidance Note Environmental Risk & Global Real Estate (1st Edition, November 2018) states that flooding may have a detrimental impact on a property.

The RICS Valuation – Global Standards (Red Book Global 2022) in VPGA 8 (Valuation of Real Property Interests) confirms that valuers must take into account flooding as part of their valuation reporting. This includes identifying the presence or potential presence of flooding through inspection, normal enquiries and/or local knowledge. This includes the risks and consequences of a flooding event occurring.

The Home Survey Standard also confirms that flooding is an issue that should be considered within the scope of a residential survey.

The UK National Supplement reaffirms this in UK VPGA 11 Valuation for Residential Mortgage Purposes;

‘If appropriate, the valuer should make some reference to these defects, even if the subject property does not appear to be affected at the time of the inspection. Where appropriate, the valuer should advise that an environmental assessment or a mining report should be obtained’.

Depending on the level of risk, the Home Survey Standard recommends considering the following questions and reporting to the client on the outcome:

‘How many floods have occurred in the area to the specific knowledge of the chartered surveyor or have otherwise been recorded or documented in the past.

What were the flood impacts in relation to that property?

What was the source of that flooding? For example, from the rivers, the sea or localised flooding, from blocked or overloaded drains or sewerages?

Is the property protected by existing river or coastal flood defences?

Have there been any recent improvement works that may have reduced the flood risk and are any flood protection works planned?

Are the existing defences or protection works known to be properly maintained?’

RICS provide a variety of useful checklists in the Environmental Risk & Global Real Estate Guidance Note to aid the collection and reporting of information, including that relating to flood risk. Where the risk of flooding is high, a surveyor may need to recommend further advice from a specialist (such as a flood protection survey).

RICS also provide a helpful diagram showing how property professionals, more widely, might be involved with flood risk.

How can flooding affect value?

The value of a property at risk of flooding will typically be lower than a similar property, which is not at risk of flooding. This is due to the potential disruption and damage to the building (and it’s occupiers) in the event of a flood and issues relating to obtaining building insurance. However, the extent of the impact on valuation will vary widely and there is no exact rule for how to adjust for this.

The Red Book Global states that,

‘For example, if the property has suffered a recent event such as flooding this may affect the availability of insurance cover, which, if material, should be reflected in the valuation’.

A now dated RICS Information Paper Flooding: Issues of Concern to RICS Surveyors and Valuers (Residential Property) (1st Edition) provides some helpful commentary on valuing properties at risk of flooding. We have included a long excerpt below as we believe it is helpful to read in full:

‘So, in short, for the valuer, flood risk is important as one of a number of locational factors, to be recorded and reported appropriately. The valuer must consider both the inherent risk to the property and the possible implications if that risk is realised.

The impact of flood on property price can be very different between different flood locations depending on local factors and frequency of flood events:

The impact of flood events on property value declines as time elapses from the flood

Positive impacts of flood plain location such as river and coastal views can offset the negative impacts of flood risk

The cost and availability of insurance and flood mitigation measures are both important considerations in valuing property at risk of flooding.

Practically, the valuer needs to have a broad understanding of these issues and build this into advice to clients. This then helps form judgment as to how this knowledge then determines value within the context of willing buyer/willing seller acting knowledgeably about flood risk, albeit not necessarily with perfect knowledge of all risk and future risks.

Where there is a risk of flooding and/or a perceived risk to an individual property, there is likely to be an impact on desirability. This may not be translated into the market in a proportionate way, e.g. if a property is deemed to have a high flood risk, insurance may be obtained from the market at a premium cost but other locational factors may mean that its value is not significantly affected by the risk, e.g. because it has the amenity of a view of a river and/or has direct boat access to the river.

In certain circumstances the risk will have some impact though and in extreme cases, e.g. currently flood damaged property which is unlikely to benefit from Flood Re (high council tax band, for example), the impact on value may be material and may even mean it is assessed as not being readily saleable.

In the majority of cases, the valuer will be faced with the challenge of absorbing and analysing market information to assess the amount of any market effect of flood risk. The valuation of a property that suffers from flood risk is best informed by a review of sales information of comparable residential properties that are similarly affected, or the making of appropriate adjustments to reflect differences in flood risk profile.

It is also advisable to act with caution if the agreed sale price of a given property does not fully reflect the flood risk profile of the property. This may be due to special purchaser situations or buyers acting without professional advice’.

In support of this, RICS Research carried out in March 2017, in Flood Risk Mitigation and Commercial Property Advice: An International Comparison, found that:

‘There was a general consensus among practitioners that the utility underlying property value is affected negatively by flood risk, but that this effect is not consistently reflected in market values. Other locational factors generally tend to have more of an influence on market price, although prices may be subject to short term or long term impacts, especially in the period immediately following a flood’.

Only experience gained over time of valuing flood-affected properties and in-depth research into the comparable evidence will enable the valuer to value competently. Valuing properties at risk of flooding is a specialist area and, as with any valuation, carries an associated liability and risk of professional negligence, if the valuer is not sufficiently, experienced, competent and knowledgeable to undertake the task at hand'.

Valuers also need to ensure they report in line with the client’s requirements and scope of investigation in their terms of engagement, as well as the relevant RICS guidance. The Red Book Global specifically states that valuers should verify the extent of their investigations, assumptions and sources of information relied upon in relation to flooding (and other environmental matters).

Building insurance for properties at risk of flooding is easier (and less expensive) to obtain due to the joint Government and industry Flood Re scheme, which was introduced in 2016. However, insurance costs where there is a risk of flooding will be higher than for an unaffected building.

If the valuation is for secured lending, or mortgage, purposes, then the valuation surveyor will be acting on behalf of the lender client. They have a duty of care towards the lender to assess an accurate Market Value taking into account a variety of factors affecting value, including flood risk.

UK VPGA 11 of the UK National Supplement specifically states that, ‘the inspection and investigations may reveal various factors that could have a material impact on the value. These factors need to be carefully considered by the valuer in the context of the valuation. The valuer may wish to alert the lender, in advance of any final report, of any matters which raise significant concern from a valuation perspective’.

The lending decision itself will take into account the robustness of the valuation, whether insurance is available and the overall purchase decision.

As part of the lending process for a property at risk of flooding, the lender is likely to require the borrower to have building insurance, including flood cover (which can increase the cost of insurance), as a condition of the mortgage.

Lending may become harder for a borrower to secure the higher risk of flooding a property faces, for example a property in Flood Zone 3a may be harder to secure finance on than a property in Flood Zone 2.

Valuers, of course, will need to be familiar with their specific lender’s guidance in each valuation case.

Below is an example of a flood endorsement in a building insurance policy for a property at high risk of surface water flooding and at medium risk of flooding from rivers and the sea.

Whilst the environmental records may look concerning, the property has never flooded in known history! Mortgage financing was also not affected by the flood risk identified and the purchaser carried out their own due diligence to satisfy themselves about the purchase decision before committing to exchange.

How can we help?

Don't leave it too late to book your submission feedback and review, APC question pack, e-mock interview or 1-2-1 mentoring. We also provide revision quizzes, revision guides and a CPD Webinar Package.

We offer a range of short and long-term support packages in our eShop, including our popular Monthly Mentoring and Kick Start packages. These can include an RICS APC or AssocRICS Counsellor in certain circumstances.

Head to our blog archive to access even more free CPD and AssocRICS and RICS APC training and support.

Download your free AssocRICS and RICS APC resources, including e-books and revision quizzes.

Find out more about our bespoke AssocRICS and RICS APC training and support, before booking your free 15 minute consultation.

Not sure about signing up? Make sure you read what our recent successful candidates have to say in our Testimonials.

Stay tuned for our next blog post to help build a better you.

N.b. Nothing in this article constitutes legal, professional or financial advice.